Expenses, Fees, and Taxes (AB)

Settling an estate in AB can take considerable time, and incur substantial costs ... costs which ultimately reduce the size of the estate left for distribution to heirs.

Naturally, heirs don't like to see the size of their potential inheritances shrink, and often have questions about these costs. In addition to resolving estate debts as required, typical costs include:

- Administration expenses

- Executor fees

- Probate fees

- Taxes

It's possible that an executor is making mistakes or spending inappropriately, but many costs are indeed necessary, and in some cases mandated by law. If you feel that an executor is spending inappropriately, you can talk to the executor about it to understand better and see what can be done, you can object to the probate court (if the estate is undergoing probate), or as a last resort, you can file a civil lawsuit. See AB Heir Rights for more information.

Administration Expenses

An estate incurs significant costs during the settlement period, including probate fees, documentation expenses, notice publication costs, appraisal fees, maintenance of assets, monthly service costs, asset sale commissions, and more. These can add up, especially if real estate is involved, but all such expenses must be documented and approved by the court if going through probate.

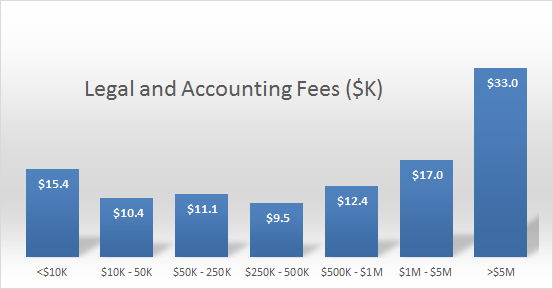

Estates usually also incur significant legal and accounting expenses, which must also be documented and approved. According to an Executor Survey, the average estate spends $12.4K on legal and accounting fees alone, with more spending at the high end of estate values.

Executor Fees

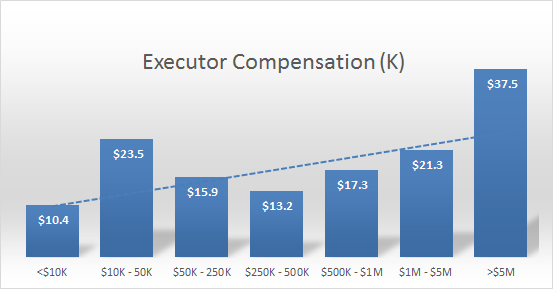

Serving as an executor requires a lot of work, and the law generally entitles executors to reasonable compensation for their services. In 2018, the average executor compensation was $18K, and the general trend was that the larger and more complex the estate, the larger the compensation.

If the will specifies executor compensation, those specified terms generally prevail. If there is no will, or the will is silent or unspecific on the matter of executor compensation, then province-specific rules come into play. Some executors choose to forego compensation for various reasons, but any compensation is paid from estate proceeds, and has priority over distributions to heirs.

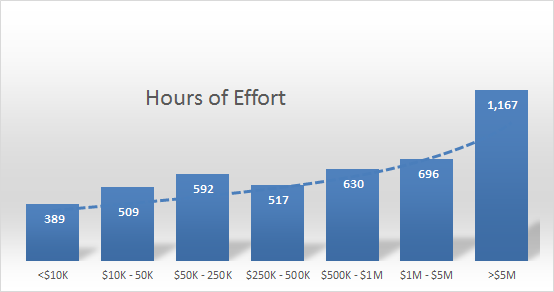

Just so you know, it takes an executor roughly 570 hours of effort on average to settle an estate, and roughly 80% of estates are settled with <800 hours of executor effort. It's almost a full-time job!

Note that executors sometimes end up paying certain estate administration expenses out of their own pockets, and executors are entitled to reimbursement for these expenses above and beyond any executor fees.

See EstateExec Executor's Guide: AB Executor Fee Calculator for general guidance and a free online calculator for province-specific executor fees.

Probate Fees

Probate court fees can vary from $0 to $100,000+ depending on estate province and value. In addition, it's common to spend thousands of dollars on lawyers and accountants – and since lawyers and accountants typically charge by the hour, having your information well-organized via EstateExec will likely pay for the EstateExec licensing fee many times over.

In Alberta, probate fees are quite reasonable, and depend on the net value of the estate subject to AB probate:

Estate Taxes

An estate is also responsible for ensuring all taxes are paid, including:

- The last year of the decedent's income taxes (and preceding years as well, if they haven't been filed)

- Income taxes for the estate during the period of estate settlement (covering things such as interest, capital gains, business income, property rental, etc.)

- Any unpaid property taxes, including taxes that become due during the period of estate settlement

Note that Canadian estates can take a big hit due to something called deemed disposition: in essence, the CRA requires the estate to pay capital gains taxes on all assets as if they had been sold at current market prices (see Deemed Disposition).

See EstateExec Executor's Guide: Paying Taxes for more information.

Your Taxes

In general, you don't have to pay any taxes when you inherit something.

That being said, retirement accounts (e.g., RRSPs, LIRAs) can be a little tricky. When someone dies, the value of the retirement account is treated as income on the decedent's final income tax return, and the estate normally pays any taxes due. However, if a retirement account has a spouse or common-law partner designated as the beneficiary, that person can choose to roll over the contents into their own registered account, deferring any tax implications. See also CRA: Death of an RRSP Owner (Publication RC4177), and note that if the estate cannot pay income taxes associated with the retirement account, the CRA has the right to go after the beneficiaries of the account for any tax obligations.

As a separate matter, when and if you eventually sell something you inherited (such as a stock or real estate), you will have to report the sale on your income tax filings, reporting your gain as the difference between the sale price and your adjusted cost base in the asset. Normally, the cost base of an asset reflects the amount you paid to purchase the asset. In the case of inheritance, it normally reflects the market value of the asset on the date of the previous owner's death. If your executor is using EstateExec, it will generate a report for you that gives you the cost base of anything you inherit, for use with your future tax filings.

See EstateExec Executor's Guide: Cost Basis for more information.

EstateExec™ Leaves More $ for Heirs!

EstateExec will likely save the estate thousands of dollars (in reduced legal and accounting expenses, plus relevant money-saving coupons), leaving more funds for distributions to heirs.

- Awarded Best Estate Executor Software in North America at the Worldwide Finance Awards

- Named Best Estate Executor Tool – – by Retirement Living

- Web Application of the Year Winner at the Globee Business Excellence Awards 2022

- Winner of Best Executor Software at the Software and Technology Awards

- Rated 4.9 stars – – on TrustPilot reviews