Estate Settlement and Executor Statistics

Show Table of ContentsEstateExec, the #1 Software for Estate Executors, has conducted extensive research on the subject of estate settlement. In a seminal study, based on more than 1,200 responses from random samples of adults (with an overall error margin of ±3%), EstateExec found that:

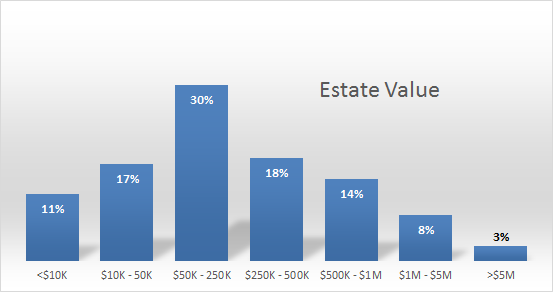

Estate Sizes

The typical estate at the time of settlement is worth between $50-$250K, with 11% under $10K, and 11% over $1M. In 2024, only estates worth >$13M are subject to US estate tax, so although many estates are still subject to federal income tax and state taxes, very few are subject to federal estate tax (some estimates place this at <0.1%).

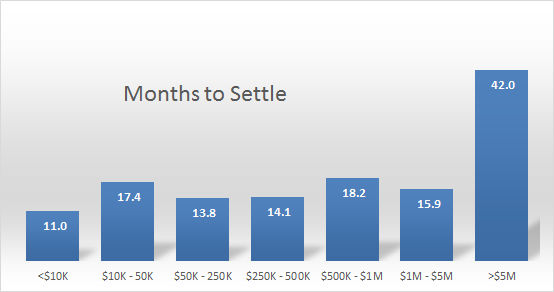

Time to Settle

On average, it takes almost 16 months to settle an estate. Very small estates (<$10K) have a somewhat shorter settlement duration, and very large estates (>$5M) take almost 3 times as long, but in between those extremes, duration is fairly unrelated to size. Roughly 80% of all estates are settled within 18 months.

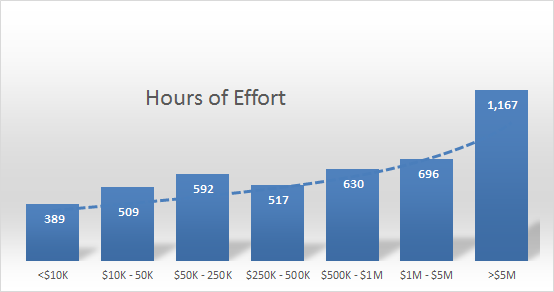

Executor Effort

It takes an executor roughly 570 hours of effort on average to settle an estate. In general, the more valuable the estate, the more effort required, although the data indicates an unexpected spike of effort in the $50-$250K range. Roughly 80% of estates are settled with <800 hours of executor effort.

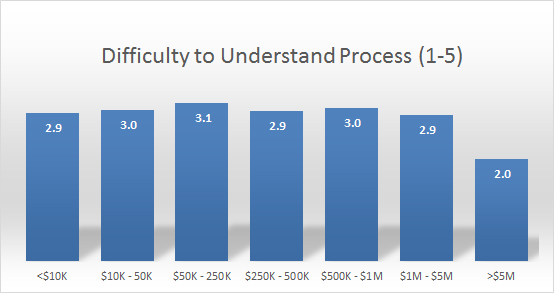

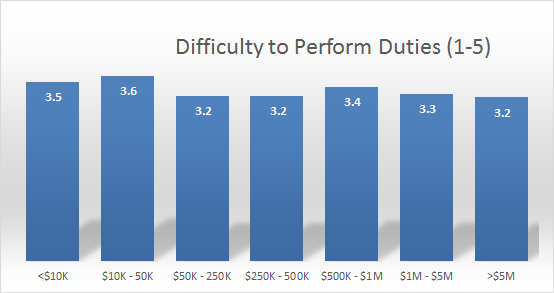

Perceived Difficulty

In general, executors feel that the settlement process is neither particularly easy nor particularly difficult to understand, with an average rating of 3.0 out of 5 (5 being “Very Difficult”). Counterintuitively, executors for estates >$5M feel that the process is easy to understand, largely due to increased reliance on professional help.

Executors feel that actually performing their duties is slightly difficult, with an average rating of 3.4 out of 5 (5 being “Very Difficult”). Size of the estate seems to have little correlation with perceived difficulty, perhaps due in part to executor expectations in relation to estate size.

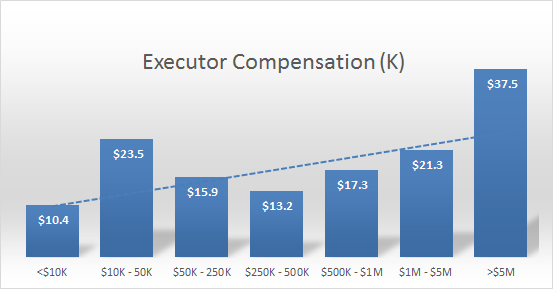

Executor Compensation

The average reported executor compensation was $18K, and the general trend is that the larger the estate, the larger the compensation (with compensation for $10K - $250K estates above trendline). However, executor compensation is governed by laws and court rulings which vary widely by state: see EstateExec's executor compensation calculator.

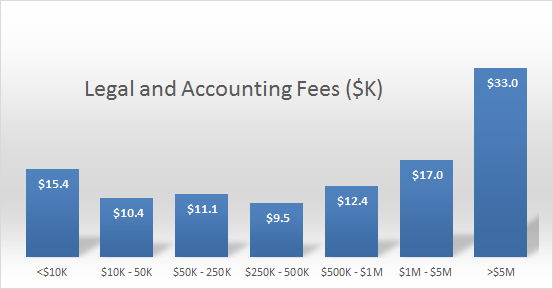

Legal and Accounting Fees

The average estate spent $12.4K on legal and accounting fees, with more spending at the high end of estate values.

Family Conflict

Family conflict, sometimes even escalating into lawsuits, is somewhat common during the estate settlement process. Over 44% of respondents had experienced or were aware of such family conflict. For example,

- My wife's family got into a dispute over their parents' estate and never spoke to each other again.

- In my mother's family, there have been two instances of inheritances breaking entire branches of our family apart.

- There was a huge fight over season tickets for the Green Bay Packers. They all took each other to court over it and 9 of them still do not talk to each other.

- Brother and sister not speaking to each other for 10+ years.

- My Dad's brother won't speak to him anymore because he's still mad ... even though it happened 10 years ago.

- My grandmother died and her granddaughters sued. They carried the suit into 9 years of conflict... I hated it.

- After my mother died, the five siblings were to split everything. One brother sued the rest of us and my sister the executrix constantly, and eventually burned up the money in the estate on lawyers we needed to defend us. He decided that if he couldn't run the show, everyone would get nothing, including him. Sad, sad story.

Causes of the conflict varied greatly, ranging from beliefs that the other party stole from the estate, to simple objection to the terms of the will. One common theme was mistrust, often engendered by lack of communication. and 19% were aware of perceived executor misconduct. For example.

- Parent with dementia takes 2 years to pass away-executor/son spends everything before the will can give equal shares to the 3 siblings.

- My dad took my sisters and my inheritance money and spent it.

- When I was 13 my grandma died. As her 1st born & closest granddaughter, I was supposed to get her amethyst ring & a pillow she had. My aunt said she never saw the stuff. A few years later, my mom noticed my cousin wearing the ring. So, auntie just took the ring & lied about it..

- My uncle left me and my mother something in his will, he told us before he died he had and where it was, but my other uncle (executor) took everything from us.

- My aunt stole my inheritance.

- A family member trusted a lawyer more than they should.

- My older sister decided to take everything except my dad's car, golf clubs, and $10000. Now she is putting all three of her children through college and I am struggling to even get a loan..

- My mother made sure her brothers didn't get their inheritance.

- My mother was responsible for distribution of assets, but my aunt took it upon herself to take over that role without our knowledge.

Then there were just the generally unhappy inheritance stories. For example,

- There were more debt collectors than family members interested in the estate... she maxed out all her credit cards and apartment loans when she knew she had only 2 weeks left to live. Next of kin and family members did not want to claim her as a relative because of debt collectors.

- Sister empties house, puts grandson on street, puts grandfather in home, and thinks the estate is hers. Then paperwork surfaces that says grandson receives estate when grandfather dies. Lawyers are battling, driving up costs. Families are greedy, scheming, selfish, immoral, etc, when it comes to money.

- My grandfather by coercion or otherwise gave all of his inheritance to a female college student at Shippensburg University. Shitbag.

- Family members taking items before will has been read.

- When my grandfather passed away he left his home to his children (my father and his siblings). But my aunt took possession of the house after some dispute (we still don't know why) and sold all my grandfather's old antiques and the house as well.

- My three aunts ignored the wishes of my grandfather by selling his cottage to one of the aunts below market value even though he had expressly told them it was to go to my mother (their sister-in-law) as my father had died prior to my grandfather's death. They also ransacked the house and took all of the antiques prior to an estate sale.

- Was contacted by a company that had discovered years later that my aunt owned stock that was not distributed when we settled her estate. I had to reopen the estate, establish an estate checking account, divide proceeds, ad infinitum.

It should be noted that while the above stories are cautionary, many of the respondents had no stories to tell, and felt that things went reasonably smoothly.

Transparent communications with the heirs and good record-keeping help minimize the potential for problems. See also Dealing with Heirs and Executor Fiduciary Duty.

EstateExec™ Makes It Easy!

Think of EstateExec as something like TurboTax®, but for estate executors.

With $$ coupons.

EstateExec includes state-specific guidance with AI software, easy financial accounting,

and even the option to work together online with your lawyer or other interested parties.

You can get started using EstateExec for free,

and if you find it useful, pay a one-time $199 licensing fee (per estate).

Plus, EstateExec provides coupons for discounts on helpful third-party services,

such as junk removal, which will more than pay for the license price!