Estate Tasks

Show Table of ContentsAn estate's Tasks Tab lists key tasks in the estate settlement process: your goal is to be able to mark all listed tasks as complete (or N/A).

EstateExec customizes the tasks according to the particulars of your estate, so this list can change somewhat over time as more becomes known about the estate. The automated list is not intended to be exhaustive, and it's likely that you will have additional tasks for your particular estate, so you can also add your own custom tasks as desired.

See also Key Duties for a high-level discussion about executor duties and individual tasks.

Task View

You can view tasks via the:

- Task Wizard – Step through the tasks one-by-one (this is the default view)

- Task List – See all tasks in a single scrollable list

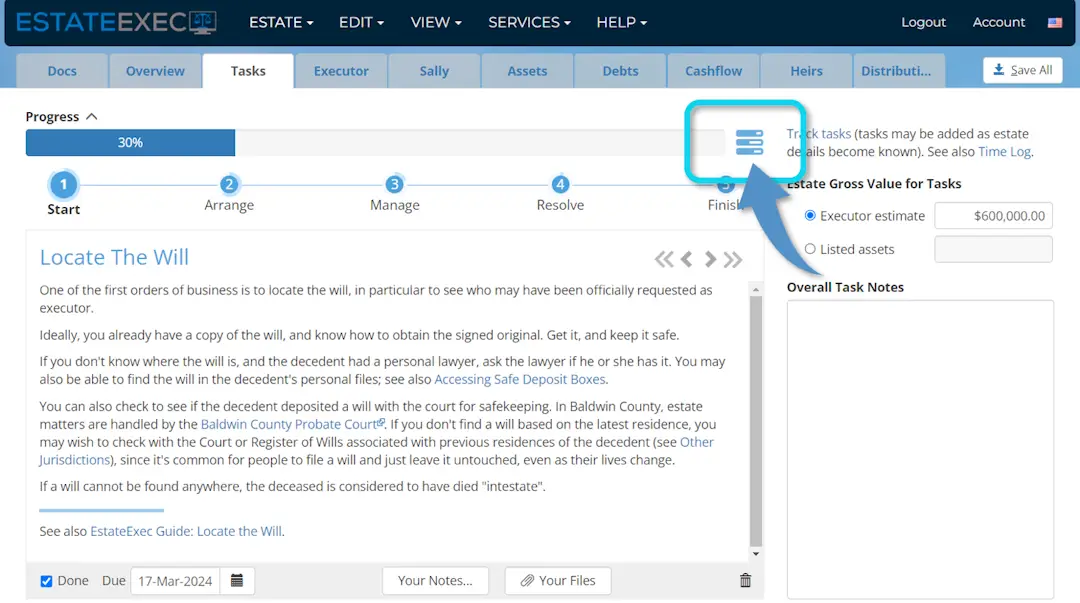

You can switch views by clicking the icon to the right of the progress bar (or use the View menu):

Sidebar

When your browser window is wide enough, EstateExec will display extra information on the side, including a space to record overall notes about estate tasks in general (of course, the normal user interface enables you to record notes associated with any individual task). You can force the sidebar to hide or display regardless of window width via the View | Sidebar menu. You can also access and control sidebar contents via the View | Task Options menu.

Estate Value

EstateExec marks certain tasks inapplicable depending on estate gross value (and other factors). When setting up a new estate, you are asked to provide a rough estimate for the estate gross value, so that EstateExec can determine the likely applicability of these tasks. You can change this estimate at any time via the Tasks Tab, you can just leave the estimate blank if you want to make decisions about these tasks yourself, and you can override the N/A determination for any task at any time.

Rather than using a gross value estimate, you can tell EstateExec to instead make these decisions based on the actual values of the assets listed on the Assets tab (although this doesn't really make sense in the early stages of the estate settlement process, when you are still trying to find all the assets and determine their values. To use actual values, select "Listed Assets" for Estate Gross Value Type in the Task Options dialog (available via the View | Task Options menu).

Services and Discounts

Some EstateExec tasks include links to third-party service providers who can help you complete the task, often with a special EstateExec discount (for example, see Task: Dispose of unwanted assets). EstateExec does not recommend or receive compensation from these discount providers; we make these offers available simply as a service to our customers. See also Discounts.