Estate Executor's Guide (QC)

Estate Executor's Guide (QC)

Show Table of Contents

When a parent or someone close to you passes away, it can be a trying experience. In addition to dealing with natural feelings of grief, there are a number of practical matters that need attention: funeral arrangements, obtaining death certificates, reading the will, probate, distributing assets, and so forth.

This Guide explains key responsibilities and tasks associated with the death of a loved one, with an emphasis on the duties of the estate executor (also known in some provinces as the personal representative, administrator, estate trustee, or liquidator).

Estate settlement varies widely by province, and this Guide will customize itself according to the province and contents of your estate (e.g., customizing court locations, small estate rules, taxation, executor compensation, family entitlements, probate court forms, debt statute of limitations, and more). Note that while an "estate" is called a "succession" in Quebec, this Guide generally uses the term "estate" just to keep things simple.

EstateExec was awarded Best Executor Software in North America in 2025 (and every year prior), was named Web Application of the Year at the Globee Business Excellence Awards, won the Edison Award for Innovation, and has a 4.9 star rating on TrustPilot reviews. While EstateExec is not intended to provide official legal or tax advice, nor to provide exhaustive coverage for all possible situations, we hope you will find EstateExec™ useful and helpful, as many others have before you.

The QC Basics

Fundamentally, it is the estate liquidator's responsibility to manage and wind up the deceased person's estate, resolving any debts, distributing assets to heirs, and filing legal paperwork. A somewhat simplified view of the overall estate settlement process consists of the following overlapping steps:

- Arrange Funeral — Request burial or cremation, organize memorial, order death certificates, etc.

- Take Inventory — Find and organize all estate assets and debts

- Become Executor — Get officially appointed by the court (if going through probate)

- Register as Liquidator — Get official appointment via RDPRM

- Send Notifications — Notify friends and family, social insurance, banks, credit cards, etc.

- Closure of Inventory — Submit inventory closure to RDPRM

- Manage Estate — Maintain and care for assets; plan asset disposition

- Resolve Debts — Pay off debts in full, or arrange for debt forgiveness

- File Taxes — Submit relevant tax returns: decedent income, estate income, etc.

- Make Distributions — Distribute net assets to heirs

- Wrap It Up — Finalize the estate settlement, including probate final accounting (if applicable)

At multiple stages along the way you may have to file legal and tax paperwork, and while EstateExec will supply relevant information, it may be helpful to work together with a lawyer (see Do I Need a Lawyer?). While many estates must go through probate, which is the court-supervised version of estate settlement, the diagram below illustrates the steps that generally apply to every estate, although Quebec successions are slightly different and EstateExec will guide you through those differences:

Like so many things in life, being an estate executor can become an all-consuming activity if you let it. While individual circumstances may sometimes require significant effort, it is EstateExec's job to try to minimize that effort, to help you through the basic process, and to organize the relevant information to make it easier for you and everyone involved.

Duties by Time Period

Click links in the table below, or the content tree to the left, to learn about various tasks. If you are using EstateExec™ it will customize an interactive checklist for you, incorporate QC-specific requirements, calculate due dates, and more (see estate Tasks Tab).

| In Advance | Get contacts, obtain copies of important documents, etc. |

| First Week | Notify close friends and family, arrange funeral, order death certificates, etc. |

| First Month | Notify Service Canada, decide whether to hire a lawyer, etc. |

| First 3 Months | Notify insurance companies, open estate account, begin probate, etc. |

| Calendar Year | File annual property and income tax returns |

| General Tasks | Pay off debts, pay estate taxes, plan asset distributions, etc. |

| Final Tasks | Make distributions, finalize probate, close estate account, etc. |

Some tasks can be performed by anyone, such as notifying next of kin, while others have strict legal requirements. For example, some provinces require that an estate administrator reside in the decedent's province. If you are using EstateExec, it will indicate the rules that apply to your situation.

The Estate (i.e., Succession)

An estate consists of a person's assets (e.g., house, bank account) and debts (e.g., mortgage, credit card balance). In Quebec, this concept of an estate is known as the "succession". It can be helpful to think of an estate as the sum of:

- Assets Subject to Automatic Transfer: Certain assets, such as life insurance policies and RRSPs, transfer automatically upon death to named beneficiaries. An estate executor has no control over such transfers, but you may be still be helpful in the process, and such assets are considered part of the estate for tax purposes. If no beneficiaries have been named, then the assets end up transferring to the estate itself, and must be settled by the executor along with the rest of the estate.

- Trusts: An executor also has no control over trusts the decedent previously established (unless you also happen to be named a trustee of the trust). See also Trusts.

- Other Items: Everything else is your responsibility, and must usually be settled via probate or a small-estate settlement procedure (see next section). If the will requires you to establish a new trust (i.e., a testamentary trust), the assets intended for the trust must first go through such a settlement procedure.

You can track and manage all such aspects of an estate using EstateExec (although you may want to establish a separate EstateExec "estate" for handling the inner workings of a complex trust).

Liquidating a Succession

In Quebec, you may be required to probate a will to prove its authenticity (see Probate for details). Once the will has been dealt with, you must then "liquidate the succession" (known as "settling the estate" in other provinces). In Québec, this requires you to interact with Le Registre des Droits Personnels et Réels Mobiliers (RDPRM), as well as other agencies such as Revenu Québec See Liquidating a Succession for an overview of these interactions.

In Québec, the Superior Court in the judicial district in which the deceased lived handles probate and estate administration (see court locations).

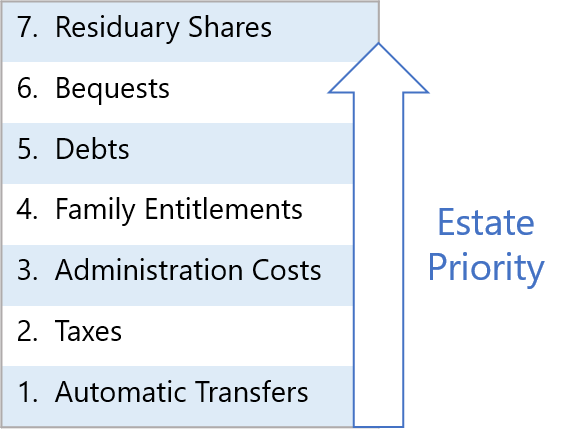

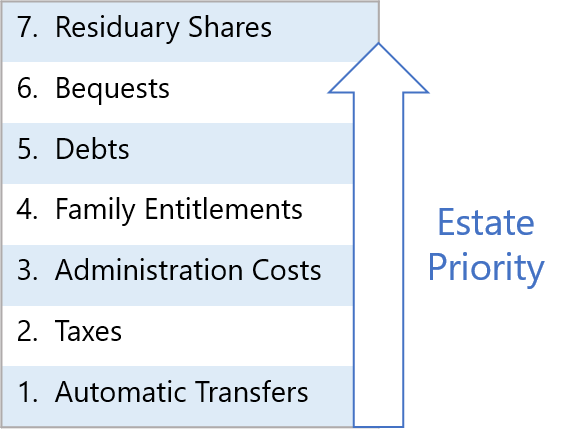

Distribution Priorities

When distributing estate proceeds, you must be sure to satisfy its obligations in a defined priority order (see diagram). Certain transfers (such as to RRSP beneficiaries) happen automatically outside the control of the estate, and the estate itself must then ensure it has enough funds to pay all taxes, then to pay estate administration costs, then any family entitlements, then any general debts, and with anything left over, fulfill any bequests, and finally distribute the residuary estate. If the estate runs out of money handling one priority, then subsequent priorities are left with nothing.

Note that provincial law determines which debts have priority over other debts, and some debts (such as funeral expenses) often have priority over family entitlements, but these specifics really only matter if the estate cannot pay all its bills (see Insolvent Estates for more details).

Key Topics

You can click the links below, or in the table of contents to the left, to learn more about key aspects of serving as an estate executor. Aside from a number of legal checklist items, perhaps the central responsibility of an estate executor is to resolve estate obligations and distribute net assets to the heirs.

- Duties

- Probate in QC

- Do I Need a Lawyer?

- Common Mistakes

- Estate Financials

- Taking Inventory

- Managing Assets

- Resolving Debts

- Paying Taxes

- Making Distributions

- Passing of Accounts

- Executor Compensation

Careful Record Keeping

It's important to keep good records during this process, as you may need to account for your actions to the court or to other heirs. EstateExec makes estate administration easy, in essence providing a powerful spreadsheet custom-built for handling the estate settlement process, including automatic integration between the various tabs and activities so everything tracks automatically and minimizes errors. Moreover, EstateExec can then use these records to calculate things such as adjusted cost base, executor fees, and more. EstateExec may also be able to optionally download transactions directly from your bank, reducing drudgery and further minimizing the chance for error. And with EstateExec, you can access your records from anywhere, save them in PDF format, print them out, or even import the results into other programs.

EstateExec™ Makes It Easy!

Think of EstateExec as something like TurboTax®, but for estate executors.

With $$ coupons.

EstateExec includes province-specific guidance with AI software, easy financial accounting,

and even the option to work together online with your lawyer or other interested parties.

You can get started using EstateExec for free,

and if you find it useful, pay a one-time CA$199 licensing fee (per estate).

Plus, EstateExec provides coupons for discounts on helpful third-party services,

such as junk removal, which will more than pay for the license price!