Estate Financials

Show Table of Contents

Managing estate financials is at the heart of the executor process, and involves a variety of elements: estate income and expenses, state and federal taxes, asset liquidation, debt resolution, and more.

General

The executor has a fiduciary duty to manage estate financials for the good of the estate, and to settle the estate in accordance with applicable laws and will directives.

It is important throughout this process that the executor keep excellent records, since some or all of these records may be required by the court, and because the process can otherwise become confusing and error-prone (see Common Executor Mistakes).

Using EstateExec can help organize and automate this record-keeping, with the Cashflow tab serving as the central ledger (i.e., spreadsheet) for all these activities. Even if the executor is using a lawyer and/or an accountant, EstateExec can be very helpful to all parties in organizing and tracking all this financial information, and in generating a Final Accounting Report.

Estate Income and Expenses

An estate typically incurs a variety of expenses:

- Funeral and associated expenses

- Ongoing mortgage payments, property taxes, utility bills, and other property-related services

- Cleaning, repair, and disposal services

- Postage and copying fees

- Legal and financial services

- Other expenses incurred by the executor

Many estates will also generate income during the settlement process, and this must be tracked and reported as well:

- Interest and realized capital gains

- Business and rental income

- Other

Executors normally open a so-called estate account at a commercial bank to handle these transactions (you do not have authority to write checks from a decedent's account, and even if you had power of attorney, that generally disappears upon the decedent's death). While it would be convenient to open such an account immediately, you will almost certainly need to wait until you can provide a copy of the death certificate and an EIN, leaving you in the awkward state of having to pay for any interim expenses out of your own pocket, to be reimbursed once you can get access to the estate assets, or to obtain a loan for the estate. Once you have opened an estate account, you will normally fund it by transferring funds from other estate assets, or even selling certain assets.

When using EstateExec, you can track estate transactions via the Cashflow tab (see Manage Estate Cash). It might be tempting to try to record these transactions in a basic spreadsheet, but using EstateExec will greatly simplify your efforts as you begin to sell off and distribute assets, pay down debts, transfer funds, generate required reports, and more (see EstateExec Integration). Plus, EstateExec can download estate account transactions directly from your bank, saving effort and minimizing manual data entry errors.

Financial Priorities

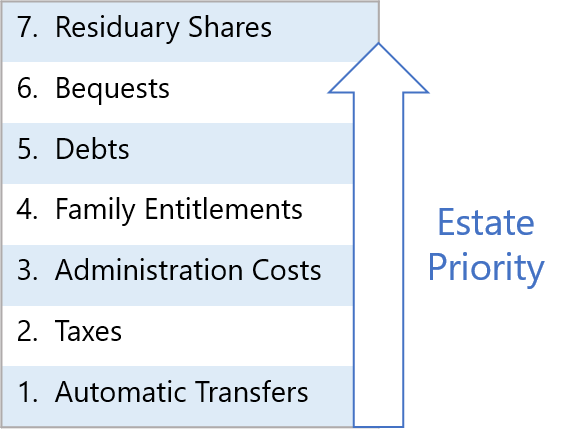

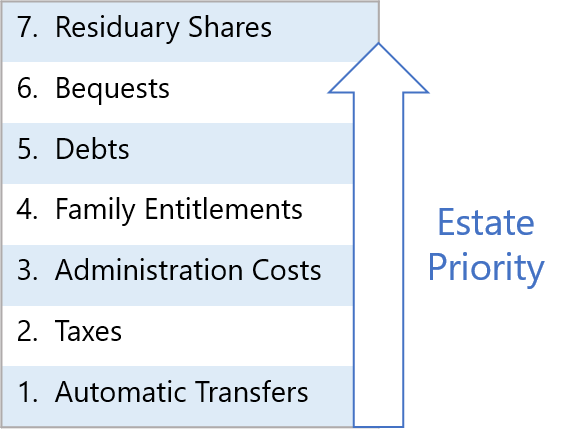

When disbursing funds, an estate must give preference to its obligations in a defined priority order (see diagram). Certain transfers (such as to IRA beneficiaries) happen automatically outside the control of the estate, and the estate itself must then ensure it has enough funds to pay all taxes, then estate administration costs, then any family entitlements, then any general debts, and with anything left over, fulfill any bequests, and finally distribute the residuary estate. If the estate runs out of money handling one priority, then subsequent priorities are left with nothing.

Note that state law determines which debts have priority over other debts, and some debts (such as funeral expenses) often have priority over family entitlements, but these specifics really only matter if the estate cannot pay all its bills (see Insolvent Estates for more details).

Real Property Considerations

In some states, the courts consider that real property legally transfers to the heirs immediately upon death, and that the executor has no power over such property unless so granted by the will. Under these circumstances, an estate might not pay for post-death expenses related to the property (such as real estate taxes). In practical terms, however, the executor almost always facilitates the transfer of real property, and may even petition the court to sell the property if needed to satisfy estate debts. Consequently, the estate does often pay property taxes until the property title has been officially transferred. If you are using EstateExec, it will provide information for specific states.

Executor Expenses

As a general rule, it's probably easiest and best to pay estate expenses directly from an estate account, which you can record via the Cashflow tab as mentioned above.

Sometimes, though, an executor may find it easier to pay out of pocket, and later get reimbursed by the estate. For example, in the early days of the executor process, before the executor has obtained an EIN (task) for the estate and opened an estate account (task), it may be necessary to pay certain estate expenses (such as a utility bill). And even after you have access to an estate account, sometimes it may just be easier to pay something yourself directly (for example, cash is required, or a third party requires a type of credit card the estate doesn't have). See also Handling Early Expenses, and note that EstateExec has a special Executor Expenses table for handling out-of-pocket executor expenses.

The executor is also eligible for reimbursement of reasonable travel expenses (which may include airfare and hotel if necessary). The executor can also claim reimbursement for miles driven in his or her own vehicle for estate business, whether driving to the decedent's home for various chores, driving to the bank, or whatever else is reasonably necessary. EstateExec's Executor Expenses table will automatically calculate mileage reimbursement rates for you, using government-approved rates for the relevant dates.

Debt Resolution and Asset Liquidation

Executors are responsible for resolving estate debts, potentially selling off assets as required to resolve those debts, or simply to make estate distribution more manageable (see Managing Assets).

Note that when using EstateExec, marking an asset sold will automatically record a corresponding deposit into the Cashflow account, and marking a debt paid will automatically deduct corresponding funds from the Cashflow account, simplifying the record-keeping process and keeping everything consistent.

Federal, State, and Local Taxes

The executor is responsible for filing and paying (using estate funds) the decedent's final income taxes, the estate's income taxes throughout the settlement period, estate taxes, property taxes, and possibly inheritance taxes. See Paying Taxes for more information about these taxes.

Refunds

It's common for an estate to receive refunds for unused service contracts, overpaid taxes, etc. While you may not know about these owed refunds when you start managing an estate, they are still considered assets of the estate at death (and not treated as estate income). If you are using EstateExec, it will automatically handle all this, including proper treatment of the cost basis of the relevant deposit account).

Although much less common, if the refund is due to an estate administration payment (rather than a payment made by the decedent), then the refund should not be considered an asset at death, and can simply be recorded as an Other Desposit.

Estate Loans and Inheritance Advances

Sometimes an estate needs cash before estate funds are available, or an heir may want access to funds before the estate is ready to make distributions.

An executor should be very careful about taking out loans in advance of estate liquidity: these loans can be costly, and there are often other ways to solve problems. Moreover, an executor should almost never take out a loan to pay an heir in advance; if such payment is desired, this should be solely the heir's responsibility.

With those caveats in mind, here are some resources that may be helpful:

- Finder for Better Decisions — Explains inheritance advances and estate loans

- Inheritance Funding — Perhaps the #1 source of inheritance loans while waiting for probate to complete

- Probate Advance — Alternate source of cash advances for an estate or for an heir

- Dickey Anderson Law Firm — Pay for probate expenses, funeral costs, legal fees, taxes, mortgage payments, and more via cash advances on life insurance, inheritances, or home sales

Financial Advice

If the estate is more complex or significantly larger than the finances with which the executor normally handles, the executor may wish to consider a financial advisor. EstateExec does not recommend specific services, but here are a couple of resources that may be helpful:

- Financial Advisor Learning Center — Advice by Charles Schwab on finding an independent financial advisor

- Smart Asset — Source of financial advisors

Final Accounting

One of the final steps in the estate settlement process is the creation of a final accounting report, detailing all financial transactions involving the estate throughout the entire settlement period. See Final Accounting for requirements and general format.

EstateExec™ Makes It Easy!

EstateExec with AI software is designed to make it easy for you to manage an estate: it includes state-specific guidance, easy financial accounting, and even the option to work together online with your lawyer or other interested parties. You can get started using EstateExec for free, and if you find it useful, pay a one-time $199 licensing fee (per estate).

EstateExec will help you appropriately organize and detail financial activity, ensuring that you have good records, and can even import financial activity from most estate account banks. When the time comes, it can automatically generate an accounting report for you.