First 3 Months

Show Table of ContentsIn addition to the tasks outlined in First Week and First Month, here are some of the key tasks you should be accomplishing in the first 3 months (note that many of these tasks will require a copy of the death certificate).

Start the Probate Process

If applicable, most executors start probate 2-3 months after the decedent's death. This process will get you an official document commonly known as your "Letters", which will make it easier for you to prove your authority when dealing with various other third parties such as banks. You may need an initial estate inventory to get this process started, but you will be able to update it later. See Probate and Becoming Executor for more details.

Determine & Notify Heirs

Based upon the contents of a valid will, and/or local statutes, determine who the heirs are, and let them know. In many cases, the probate process includes specific requirements for notification of heirs (see Probate Notice). You will likely not be able to definitively tell them what, if anything, they will be inheriting until after you have determined overall estate solvency and sorted out various allocation questions, but it's nice to keep the heirs informed of the process (and required by law under certain circumstances).

Establish a Family Allowance

If the decedent left behind dependent family members, you may want to provide a living allowance for them from estate assets ... if they need it to continue their accustomed lifestyle while the estate is being settled. If the estate is going through probate, you will likely need to seek permission for such an allowance from the court, and note that there are often state-specific laws about such allowances, including laws that give priority to such an allowance over paying most estate debts. If such an allowance isn't necessary in your case, just mark the task N/A (Not Applicable) on the Tasks tab.

Forward Decedent's Mail to Yourself

It will be easier for you to have the decedent's mail delivered directly to you. You can arrange this online via the USPS (for a very small fee), you can mail a paper PS Form 3575 you pick up in person at a post office (you cannot print this form at home), or you can simply take care of this in person at a local post office (bring your proof of executor status).

Note that the postal service sometimes has difficulty forwarding mail if the decedent was living at an institution (such as an assisted living facility), since the postal service delivers mail to such institutions in bulk and leaves it up to the institution to sort out individual addresses. In such cases, the institution has responsibility for forwarding mail, but this doesn't always happen. Whether or not you are receiving forwarded email, you may want to check with any such institution to see if they have mail for the decedent.

If you opt not to have the decedent's mail forwarded at all, you may at least want to minimize junk mail so you don't have to go through it (junk mail will normally get filtered out during the forwarding process). You can do this for free online at the DMAchoice Deceased Registry, and you can separately prevent unwanted credit card offers (it's easiest to use the 5-year "temporary" option).

Carefully go through all remaining mail. You will almost certainly uncover previously unknown debts over time, and it is your fiduciary duty to ensure that these are paid (or forgiven). You may also discover dividend checks, refunds, life insurance policies, and more, not to mention correspondence from friends who should be informed of the death.

Notify Credit Cards

If the decedent had any credit cards (and who doesn't?), notify the issuers of the death, so that they will stop adding late fees and other penalties. Call each card issuer and ask to speak with “Deceased Account Services” or the “Estate Unit.” You should also try to figure out whether there were any recurring fees being charged to a card, so you can make other payment arrangements if the associated services should continue for now (e.g., electricity bills, home insurance payments, etc.).

Of course, you will want to close these credit card accounts eventually, but you typically cannot close such an account without paying off any amounts owed, and you normally should not pay off estate debts until you have published a Notice of Death, undergone the mandated waiting period, and had a chance to assess the overall financial status of the estate (see Resolving Debts).

Notify Other Agencies

While not mandatory, it's nice to clean up other official records so that the decedent's name doesn't later get entangled in various fraudulent activities:

- Contact the DMV in the decedent's state to cancel his or her driver's license and remove him or her from the voter roles

- Contact the credit reporting agencies (Equifax, Experian, and TransUnion).

- See also Typical Notifications

Obtain an EIN for the Estate

You will need an equivalent of a social security number for the estate, in this case the inappropriately named Employer Identification Number (EIN). You can apply online for an estate EIN via the IRS, or you can obtain a copy of IRS Form SS-4 and mail it in.

File IRS Form 56

While not strictly required, it's generally considered best practice to file Form 56 with the IRS, notifying the US government that you are responsible for the estate, and that all tax correspondence should go to you (reducing the risk of important mailings getting lost). When you have completed your executor duties, you will then file a corresponding Form 56, terminating your responsibilities, and this second filing will give you certain long-term legal protections.

Open an Estate Bank Account

You do not have authority to write checks from the decedent's bank account. Even if you had power of attorney, that generally disappears upon the decedent's death.

What you need to do is to open an estate account at a reputable financial institution, with you named as the executor, so you can easily pay estate expenses and deposit checks. While it would be convenient to open such an account immediately, you will almost certainly need to wait until you can provide a copy of the death certificate and an EIN (see previous tasks).

Choosing a Bank: When it comes to estate accounts, some financial institutions are easier to work with than others, and you may want to ask about their policies.

- For example, some banks require any checks to be signed by all co-executors, which can be inconvenient if you have co-executors (and some banks won't even open an estate account if there are co-executors).

- Not all banks support all states, so be sure you can set the account address to the estate's state (some states have laws prohibiting removal of funds from the state during the settlement process, and in any case, you will want any interest to be properly reported to the correct state).

-

–

Established in 1934, Quorum FCU offers streamlined support for estate accounts in all 50 states.

Their Quorum "Probate Express" Account

enables an executor to open a federally insured estate account in minutes with no fees (and no in-person visit needed).

–

Established in 1934, Quorum FCU offers streamlined support for estate accounts in all 50 states.

Their Quorum "Probate Express" Account

enables an executor to open a federally insured estate account in minutes with no fees (and no in-person visit needed).

Before you get an estate account opened, you may end up paying some estate expenses out of your own pocket, to be reimbursed once you can get access to estate funds (see Estate Financials for more details).

Find and Claim Estate Assets

A key responsibility of the executor is to locate and collect all estate assets (see Finding Assets for detailed advice). While this task is listed in "First 3 Months", and you should start in this timeframe, this task may take somewhat longer to actually complete. It's not always easy to find all estate assets, and it can be a bit of work to claim ownership of each asset for the estate. Moreover, a number of asset holders will want to see a copy of your official Letters of executor appointment, so you'll need to get probate underway before those assets can be claimed (unless you are following a Small Estates procedure, which has its own built-in delays).

If the estate is undergoing probate, once you understand the estate assets, you will need to file an estate inventory with the probate court (see Probate Forms).

Notify Life Insurance Companies

If the decedent held any current life insurance policies, you may want to notify the issuing companies, and ensure they payout in accordance with the terms of the policy. Often it is the beneficiaries that do all this, however, and the executor has no legal obligation in this regard.

Notify IRAs and Other Beneficiary Accounts

A number of financial instruments, including IRAs and 401Ks, pass directly to the named beneficiary on the account. While the executor has no control over these assets if the beneficiary has been properly designated in the account, you should notify the account managers so that they can begin their proceedings.

Assist with Right of Survivorship Property

Real estate (and other asset types) may be owned by multiple people, and this shared ownership sometimes includes right of survivorship, meaning that the surviving owner(s) automatically inherit the decedent's share upon his or her death (see Ownership Types).

When an estate contains real estate owned with right of survivorship (for example, a family home owned by a husband and wife), an Affidavit of Survivorship should be submitted to the county clerk where the property is located, affirming the deceased owner's name and date of death, the property's legal description, and the surviving owner(s) right to the property.

Here is a generic Affidavit of Survivorship, but the exact form of the affidavit may depend on multiple factors, so it's best to talk to the clerk's office to find out exactly what they want.

Deal with Firearms

Dealing with estate firearms can be a bit complex, and depends on federal, state, and local regulation, and you may be legally obligated to move quickly. See Dealing with Firearms for important details and restrictions.

Cancel Memberships and Subscriptions

To tidy things up, you may want to cancel the decedent's remaining memberships and subscriptions, such as:

- Golf and other sporting clubs

- Gym and group fitness classes

- Libraries and book clubs

- Airline, hotel, rental car, and other travel memberships

- Professional associations

- Discount purchase organizations

- Magazine subscriptions

Note that some of these memberships may have recurring dues or subscription fees, and your cancellation may entitle the estate to a refund. And some may have valuable associated loyalty points which you may want to liquidate before cancelling the associated membership (see Task: Consider Loyalty Points).

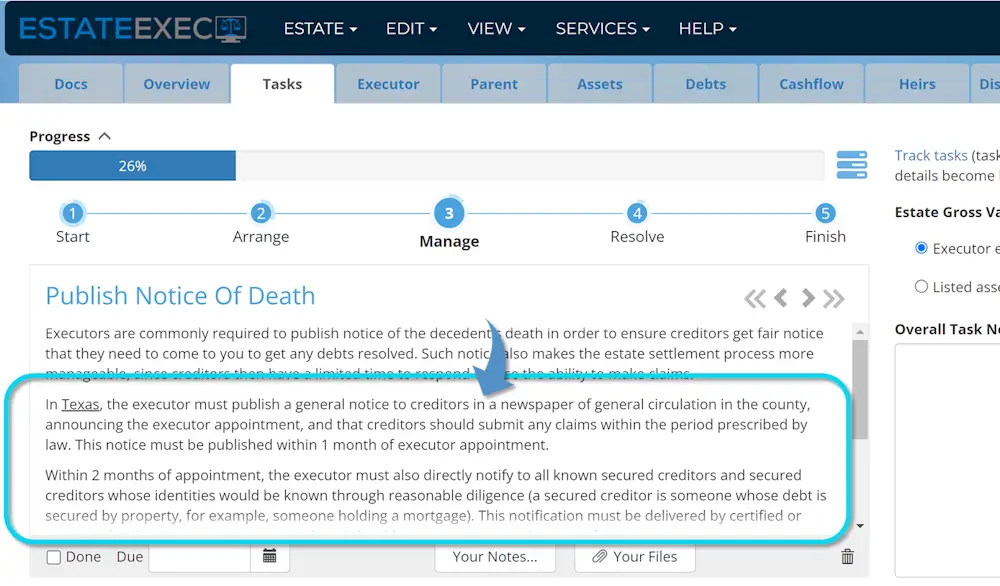

Publish a Notice of Death in a Local Newspaper

Publishing a notice of death is intended, in part, to ensure that any creditors get fair notice that they need to come to you to get their debts paid. If they do not contact you within a certain period of time after this publication, which varies by state, then they lose their ability to make any estate claims. Typically this response deadline ranges between 3-9 months, by state, and gives you protection against unknown debts that might otherwise surface long after you have distributed the entire estate proceeds. There are strict requirements for such publications if you want this legal protection, and if your estate is undergoing probate, there are often associated publication deadlines. See Finding Debts, and below is a sample EstateExec Task describing these details.

Notify Extended Acquaintances

If there are other acquaintances that haven't already been told about the death, it's nice to let them know (often in response to correspondence you will receive in the decedent's mail). This process can also be an interesting opportunity to learn more about your loved one's life.

Consider Online Media Accounts

Social media accounts, email accounts, photo storage accounts, and the like do not normally have an associated monetary value, and thus do not officially need to be included in an estate's inventory. That being said, an executor may still want to shut these down, memorialize them, or otherwise transition their contents. Trying to track all these down and somehow wrapping them up can be A LOT of work, so you'll want to consider whether handling these online media accounts is really something worthwhile: after all, the deceased is gone, and you are still living your life. At a minimum, you may want to pick and choose only the ones you consider most important. See Estate Administration of Online Media Accounts for links to the relevant pages for a few of the more popular services.

Discount $$: There are companies that can handle resolving these accounts for you: see Task: Consider Online Media Accounts for a 25% discount on these services. Note that EstateExec does not recommend or receive compensation from third-party companies; we provide these discount offers simply as a service to our customers.

Determine Asset Values

Asset values are used to determine appropriate: taxes, estate settlement process, allocation among heirs, and cost basis for future sales (by the estate or eventually by the heirs).

You may want to do some quick, initial estimates in order to determine the best estate settlement approach, but eventually you will need detailed, defensible valuations for every estate asset ... as of the time of death, and as of the time of settlement (sale or distribution). See Determining Value for detailed valuation advice.

Start to Assess Estate Solvency

You should have a pretty good sense by this point as to whether the estate owes more than it is worth, or not. If the estate clearly owes significantly more than it is worth, you may want to wash your hands of the whole thing, declare the estate bankrupt, and turn it over to the courts for disposition.

Begin an Asset Disposition Plan

Some assets may be explicitly called out in the will for specific disposition. You may need to sell some assets to raise cash to pay off debts. Some heirs may want their share of the estate to include particular assets. You need to develop an asset plan that satisfies your legal obligations and preferably, maximizes heir happiness. See Managing Assets.

See also Overall Timeline for the entire settlement process, and see Calendar Year for tax-related tasks that may have to be accomplished within the first 3 months, depending on date of death.

Note that once you enter the decedent's date of death in the Decedent Tab, and begin to fill out more information about the estate, EstateExec will calculate the relevant due dates for all of the listed tasks (and others), and display them in the estate's Tasks Tab.