Making Estate Distributions (MN)

An estate distribution is the delivery of cash or an asset to a given heir. After resolving debts and paying any taxes due, the executor should distribute the remaining estate to the heirs in accordance with the instructions in the will (or as dictated by the court).

General Plan

Before making any distributions from

After ensuring you have inventoried all assets, including their ownership types and valuations, and have been informed of all estate debts, it's usually easiest to try to plan things in this order:

- Record Automatic Transfers — Define distributions for assets over which you have no control (i.e., 401Ks, life insurance policies, etc.)

- Account for MN Family Entitlements — Define distributions for any Family Entitlements that will be utilized

- Allocate Bequests — Define distributions for any specific bequests made in the will

- Prepare for Debt Resolution — Ensure you will have enough cash to resolve the debts, planning to sell assets if necessary

- Determine Executor Compensation — Decide the amount of executor fee you will take, as prescribed by MN law

- Mark Assets for Sale or Distribution — Plan remainder of asset disposition

- Allocate Distributions — Define distributions so that each heir will get the proper share of the final estate

If the estate will not have enough free cash to resolve all debts, even after liquidating all available assets in step 5, you may need to revisit some of the earlier steps in an attempt to satisfy estate creditors, since debts generally have precedence over other estate claims.

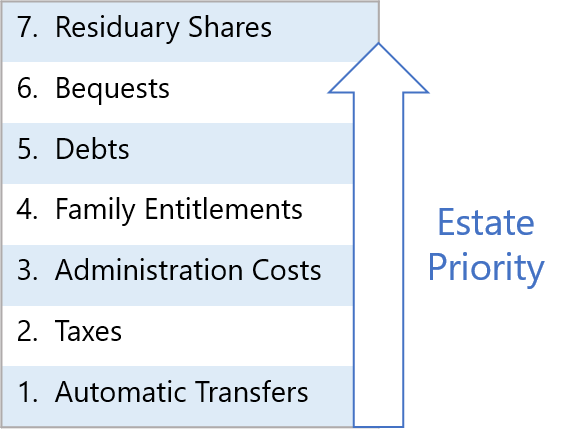

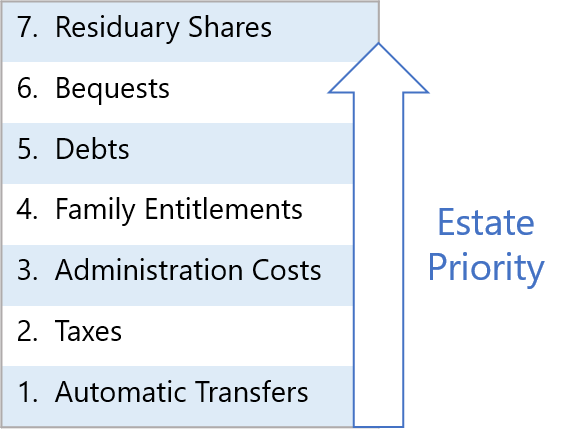

The steps outlined above work well for an estate that can ultimately pay its bills, but if not, you will need to keep in mind that an estate must give preference to its obligations in a defined priority order (see diagram). Certain transfers (such as to IRA beneficiaries) happen automatically outside the control of the estate, and the estate itself must then ensure it has enough funds to pay all taxes, then estate administration costs (including executor fees), then any family entitlements, then any general debts, and with anything left over, fulfill any bequests, and finally distribute the residuary estate. If the estate runs out of money handling one priority, then subsequent priorities are left with nothing.

Note that state law determines which debts have priority over other debts, and some debts (such as funeral expenses) often have priority over family entitlements, but these specifics really only matter if the estate cannot pay all its bills (see Insolvent Estates for more details).

EstateExec makes the overall planning process easier by allowing you to mark whether you plan to sell or distribute each asset (see Reference: Asset Planning), and to define proposed distributions to each heir before actually making them (see Reference: Manage Distributions). You can then see at a glance which assets and heirs need more attention, and the Overview tab will show you overall estate progress.

Automatic Transfers

Certain items change ownership or pay out "automatically" upon death: life insurance policies, property held in joint tenancy or community property with right of survivorship, funds in an IRA or 401K for which a beneficiary was named, stocks held in a transfer-on-death account, and so forth. An executor does not take possession of such items, or control them, but frequently ends up facilitating their transfer (contacting the organizations, providing copies of the death certificate, etc.). While such items are not subject to MN probate, they can impact the estate settlement process (in terms of taxes owed, calculating certain family entitlements, etc.).

Tip: EstateExec understands that such assets are not usually subject to MN probate, and will automatically handle them accordingly (you can manually override this if desired; see EstateExec Reference: Identify Assets Subject to Probate). In any case, you should create Distributions for each such item with the "Reason" identified as "Automatic".

Family Entitlements

Minnesota allows a surviving spouse and any children to claim certain entitlements that supersede most other estate claims, in the following cumulative order:

Homestead Exemption

Minnesota allows homeowners to claim up to $510,000 in house and land (or $1,275,000 if agricultural) as a "homestead" (see MN Stat § 510.12).

A spouse is entitled to inherit this homestead, and upon his or her death, have it pass to any surviving descendants of the decedent. If there is no surviving spouse, then any surviving descendants are entitled to inherit the homestead directly. If the will specifies a different disposition, then the spouse can file a petition with the court to claim it.

When inherited by the family as outlined above, the homestead is immune to claims from estate creditors (other than debts related to state-provided medical care).

See MN Stat § 524.2-402.

Family Living Allowance

A surviving spouse and any children (whom the decedent was supporting, or was obligated to support) are entitled to a reasonable family living allowance up to $2,300/month for 18 months (reduced to 12 months if the estate cannot pay all its debts).

The family allowance has priority over all claims against the estate, and is in addition to anything to which the family would otherwise be entitled.

See MN Stat § 524.2-404.

Personal Property Exemption

A surviving spouse is entitled to the following property from the estate (in addition to anything else the family would normally inherit):

- Up to $15,000 in household furniture, furnishings, appliances, and personal effects

- One automobile (if one exists)

See MN Stat § 524.2-403.

Surviving Spouse Elective Share

Regardless of what the will says, a surviving spouse is optionally entitled to claim a percentage of the "augmented estate".

The augmented estate is defined as:

- The decedent's net probate estate

- The decedent's non-probate transfers to others

- The surviving spouse's property and non-probate transfers to others

The percentage the spouse can claim depends on the duration of the marriage:

- 1-10 years: 3% per full year of marriage (i.e., 15% after 5.5 years of marriage)

- 11-14 years: An additional 4% per year (i.e., 38% after 12 years

- 15+ years: 50%

If the spouse will essentially be left with <$75K, the amount of the estate claimed should be increased by a supplemental elective share in order to reach $75K. More precisely, the total is computed by adding the spouse's property (and non-probate transfers to other), the decedent's non-probate transfers to the spouse (e.g., 401K beneficiary), and the portion of decedent's net probate estate (and non-probate transfers to others) payable to the spouse under the primary elective share.

The elective share is primarily a distribution allocation exercise; the elective share has no special protection from creditor claims.

A surviving spouse has 9 months from the death to decide about taking an elective share, or 6 months from probate of the decedent's will, whichever comes later.

Specific Bequests

Wills sometimes specify that certain assets or dollar amounts are to be distributed to certain heirs. Such bequests should be generally be handled before dealing with the residuary estate, in which percentages of the remaining estate are allocated to the appropriate heirs. You can mark these bequests via the Distribution dialog (see Manage Distributions).

However, not all bequests can be honored: sometimes the asset is no longer part of the estate; sometimes the bequest conflicts with local law (e.g., community property with right of survivorship); sometimes the asset must be sold (as a last resort) in order to pay estate debts.

The process of reducing bequests is called abatement, and any required reductions are typically made proportionately to the recipients. For example, if the estate is worth $50K and there are several bequests that total $100K, all bequests would be reduced by 50%. Similarly, if the will bequeaths three pianos to a particular heir, and there are only two pianos in the estate, then the heir would receive just two pianos. And if there were no pianos in the estate, then that bequest would remain unfulfilled (known as ademption). Even if the estate has plenty of money left over, the executor cannot "make up" for an abatement or ademption; in this example, the executor cannot buy the heir a piano using other estate funds, or just provide extra cash in lieu of the piano.

Heir Percentages of the Estate

Wills usually specify a percentage that each heir should receive of the residuary estate

(the residuary estate is the amount remaining after all debts and obligations have been satisfied, and any specific bequests handled).

For example, if

If there is no will, then MN law will dictate the heirs and associated residuary percentages.

Residuary percentages do not need to be realized as single lump sum cash payments, but may be composed of multiple distributions, in various combinations of cash and property.

Tip: You can enter these target percentages on the EstateExec Heirs tab, and as you define distributions, see how you are doing in reaching these targets in the Heir Target Allocation chart on the Overview tab (for additional tips, see EstateExec Reference: Manage Distributions).

Heir Debts

In some cases, a decedent dies with an heir (or multiple heirs) owing the decedent money. As an executor, you do not have legal authority to simply forgive (i.e., cancel) such debts: it would be unfair to the other heirs. The heir to whom the money was lent can either repay the estate the amount owed, or you can distribute the loan as an "asset" to some other heir, or you can deem that such repayment has been made as a portion of the inheritance otherwise owed that heir. For example, if an heir owes the estate $10K, and is entitled to $50K in distributions from the estate, you can distribute that $10K loan "asset" to the heir, and plus $40K in other distributions.

Charitable Donations

A charitable donation is really just an estate distribution to a particular type of heir (a charity). The executor does not have the right to give away items of value to charities unless specifically authorized by the will or the court.

Distribution Completion and Receipts

Actually making distributions to heirs is usually one of the last things the executor does in settling an estate in MN. Although it is best practice to make all the distributions at the end of the process, it is usually permissible to make some distributions earlier if desired (see Early Distributions).

It is good practice to require all heirs to sign a receipt for any distributions (the receipt can cover multiple items). When making final distributions to an heir, it is also good practice to have that person sign a document (perhaps prepared by an attorney), stating that he or she approves of your actions as executor and confirms that he or she has received everything due.

Additional Information

See also EstateExec Reference: Manage Distributions for specifics about using EstateExec to organize, plan, and document distributions that satisfy the directives of the will (and/or the court).

In case you're interested, details about making distributions in other states can be found here: